|

April (2024)

Jiangxi Black Cat Carbon Black: 2023 Q4 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q4 | 2657.8 | 2588.9 | 2.7 | | | All Segments | EBIT | Q4 | 32.5 | -25.2 | 229.0 | | | All Segments | Net Margin | Q4 | -215.6 | -28.4 | -658.2 | |

Orion Engineered Carbons: Breaks Ground on Battery Materials Plant in Texas Link...

Orion has broken ground on a plant in Texas that will be the only facility in the U.S. producing acetylene-based conductive additives for lithium-ion batteries and other applications vital for the global shift to electrification. The site is based in the city of La Porte, southeast of Houston. The battery additives produced by Orion’s plant will be super clean, with only one-tenth of the carbon footprint of other commonly used materials. The additives produced at the La Porte plant will be made from acetylene, a colorless gas that Orion’s production process turns into powder with exceptional purity demanded by leading battery manufacturers. The acetylene will be supplied by a neighboring site owned by Equistar Chemicals LP, a subsidiary of LyondellBasell. Key equipment procurement and off-site fabrication are already at an advanced stage. Field construction activities are ramping up, with the facility start-up expected in the second quarter of 2025.

March (2024)

Cabot Corporation: Wins Tire Technology International 2024 Award for Its E2C® DX9660 Engineered Elastomer Composite Link...

Cabot Corporation has won the Tire Technology International 2024 Awards for Innovation and Excellence in the “Chemicals and Compounding Innovation of the Year” category for its E2C DX9660 engineered elastomer composite. The award recognises Cabot's E2C DX9660 as a solution that delivers performance and sustainability benefits for tire customers across the globe. E2C DX9660 elastomer composite is produced in a proprietary and patented mixing process that enables superior carbon black dispersion and improved rubber properties for on-road commercial tire applications. Utilizing Cabot’s Light Touch™ mixing guidelines, its DX9660 grade delivers an approximately 30% increase in abrasion resistance without sacrificing rolling resistance over conventional compounds. The on-road performance of this product has been validated by customers globally. Furthermore, by delivering high levels of tread wear resistance, the DX9660 solution results in a reduction of end-of-life tires, thereby enabling a more sustainable future.

Cabot Corporation: Launches PROPEL® E8 Engineered Reinforcing Carbon Black for Tire Tread Applications Link...

Cabot has launched its new PROPEL® E8 engineered reinforcing carbon black designed to provide superior tread durability at low rolling resistance for high-performance tire tread applications. The product addresses the unique challenges posed by the heavier weight and higher torque of electric vehicles compared to traditional internal combustion engine vehicles. The PROPEL E8 grade complements Cabot’s existing solutions within the PROPEL E series, which are also suitable for use in high-performance tires. The treads of EV tires require a performance balance difficult to meet with traditional, high surface area ASTM carbon blacks. The PROPEL E8 solution enables better rolling resistance when compared to ASTM N200 and N100 carbon black grades. It also provides high stiffness and modulus with abrasion resistance equal to ASTM N100 series carbon black. The PROPEL E8 grade complements the other solutions in its PROPEL E portfolio including grades PROPEL E3, PROPEL E6 and PROPEL E7, which can also deliver performance and sustainability benefits for various high-performance tire formulations. Cabot’s PROPEL E series is comprised of high surface area, medium structure reinforcing carbon blacks specifically engineered to increase the overall sustainability of the tire value chain, enabling tread formulators to deliver tires with low rolling resistance for maximum range while enhancing tread durability to extend tire life span, resulting in fewer EOLTs. In addition, PROPEL E3 carbon black considerably reduces hysteresis enabling low rolling resistance, which is a critical design consideration for EV tires to maximize range.

China Synthetic Rubber Corporation: 2023 FY & Q4 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023 | 17415.6 | 21724.6 | -19.8 | | | Carbon Black | EBIT | 2023 | -124.0 | 339.3 | -136.5 | | | Carbon Black | Sales Revenue | Q4 | 4427.9 | 5215.1 | -15.1 | | | Carbon Black | EBIT | Q4 | 168.3 | -71.8 | 334.3 | |

February (2024)

Thai Carbon: 2023 Q3 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 3295.0 | 2918.7 | 12.9 | | | Carbon Black | Direct Total | Q3 | 2572.4 | 2690.4 | -4.4 | | | Carbon Black | EBIT | Q3 | 191.4 | -831.0 | 123.0 | |

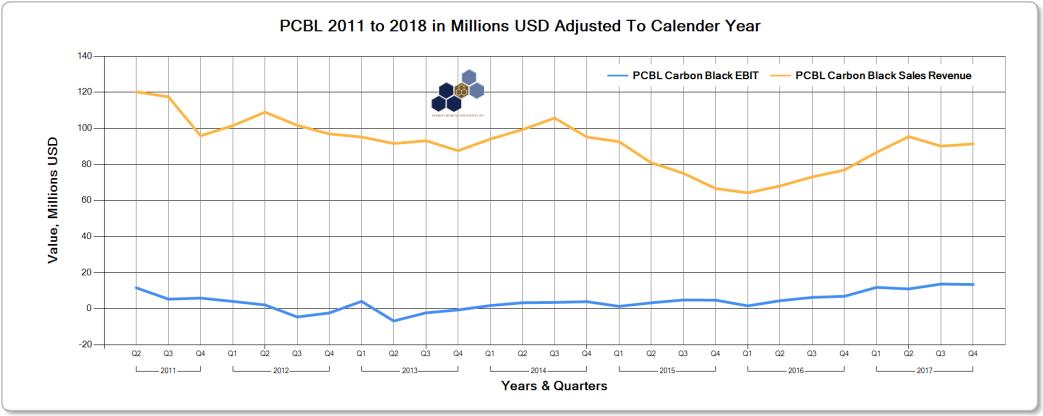

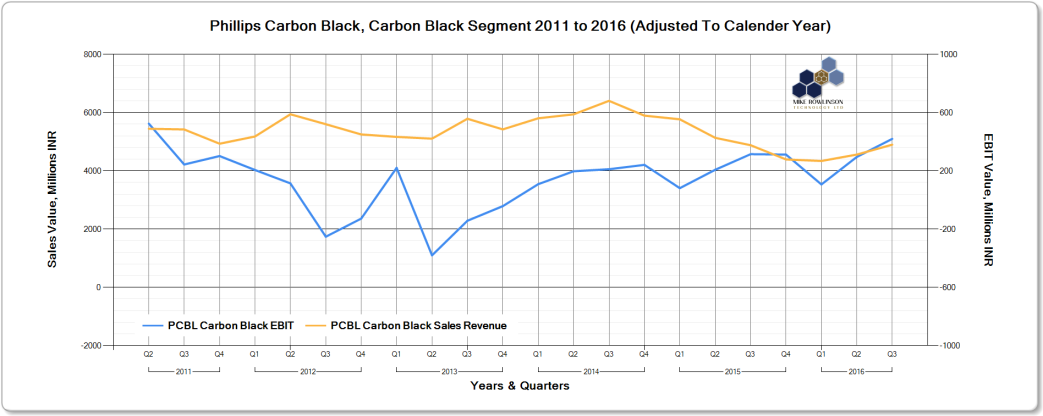

Phillips Carbon Black Ltd: 2023 Q3 Results Link...

Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 16149.6 | 13314.3 | 21.3 | | | Carbon Black | EBIT | Q3 | 2524.0 | 1671.9 | 51.0 | | | Carbon Black | Sales Vol MT | Q3 | 136108.0 | 92000.0 | 47.9 | |

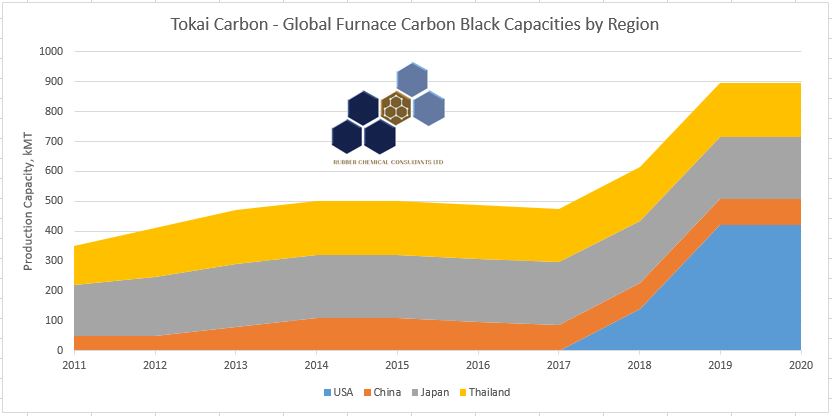

Tokai Group: 2023 Q4 Results Link...

Tokai Group: Volumes decreased slightly due to prolonged periods of production adjustments for TBR tires and weak demand for non-tire products. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q4 | 37292.0 | 35134.0 | 6.1 | 1 | | Carbon Black | EBIT | Q4 | 5378.0 | 3296.0 | 63.2 | |

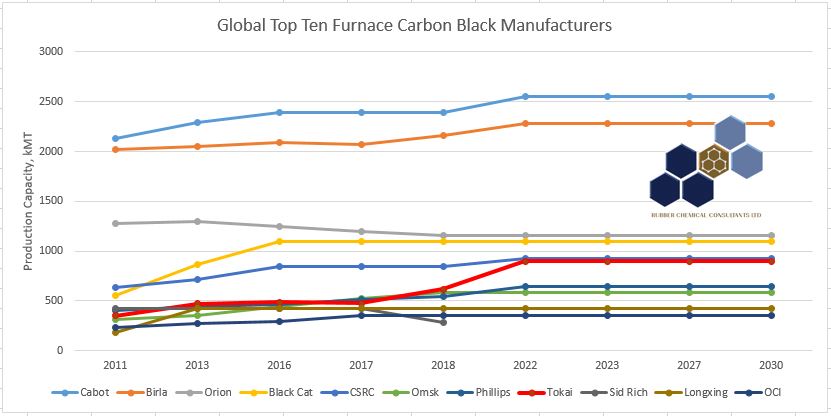

Cabot Corporation: 2024 Q1 Results Link...

Cabot Corporation: Reinforcing: volumes up in Europe and Asia (+2% global), modest sequential volume improvements expected. EBIT improvements through favourable pricing and product mix from 2023 customer agreements. Performance: Volumes up 10% with sequential volume increase expected driven by seasonality. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2024 | 2023 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 851.0 | 854.0 | -.4 | 1 | | Carbon Black | EBIT | Q1 | 154.1 | 115.4 | 33.5 | | | Rubber Black | Sales Revenue | Q1 | 641.0 | 643.0 | -.3 | 2 | | Rubber Black | EBIT | Q1 | 129.0 | 94.0 | 37.2 | | | Rubber Black | Sales Vol YoY % | Q1 | 102.0 | 95.0 | 7.4 | 3 | | Specialist Black | Sales Revenue | Q1 | 210.0 | 211.0 | -.5 | 4 | | Specialist Black | EBIT | Q1 | 25.1 | 21.4 | 17.2 | |

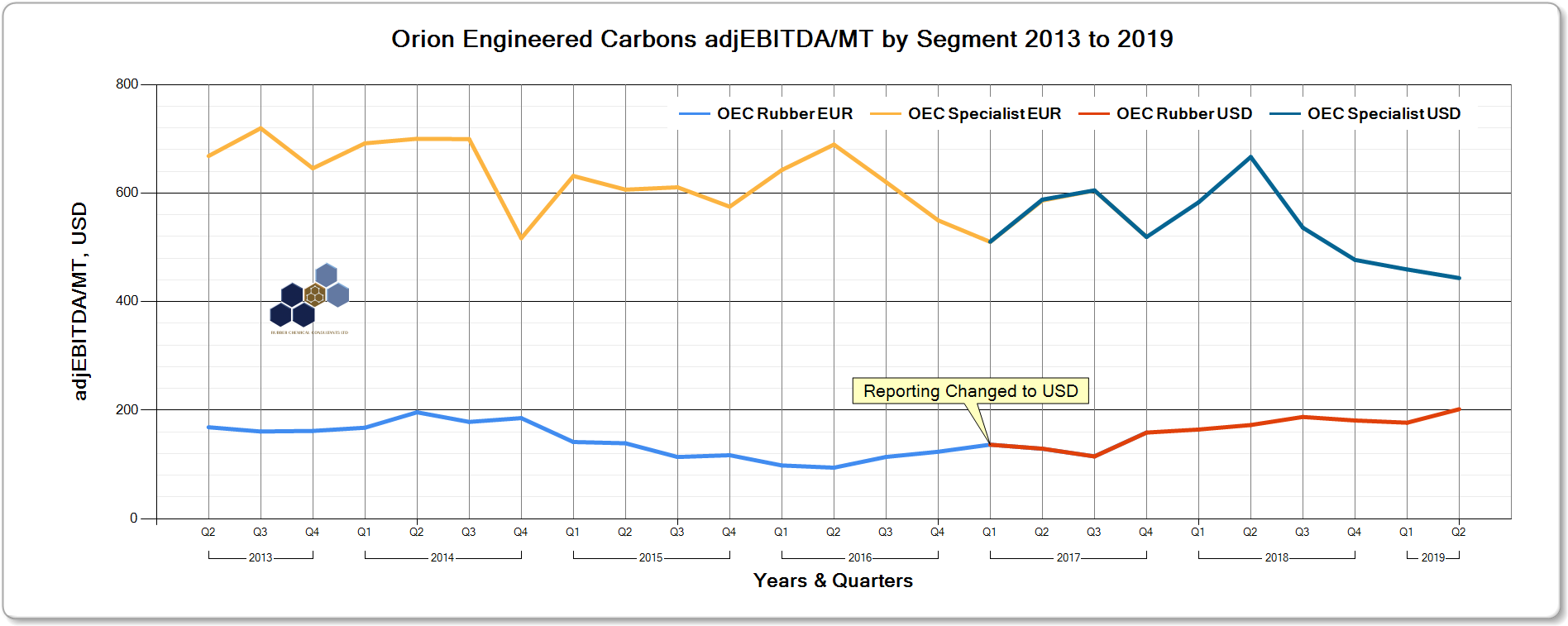

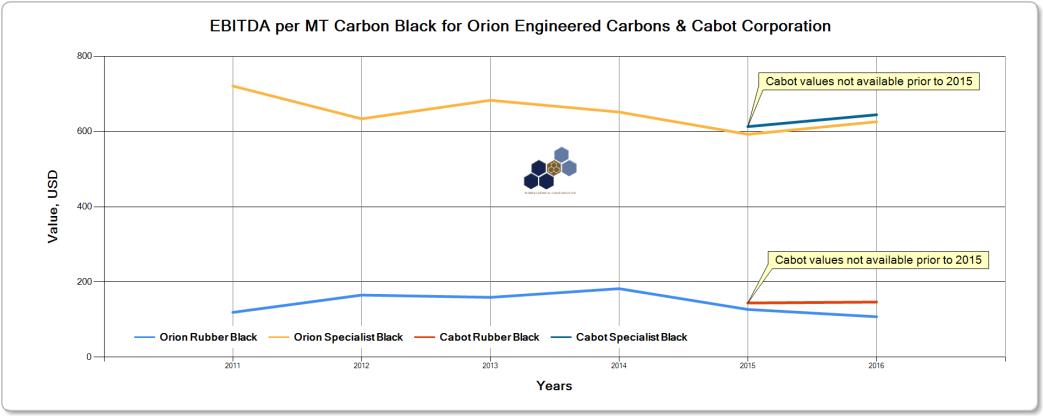

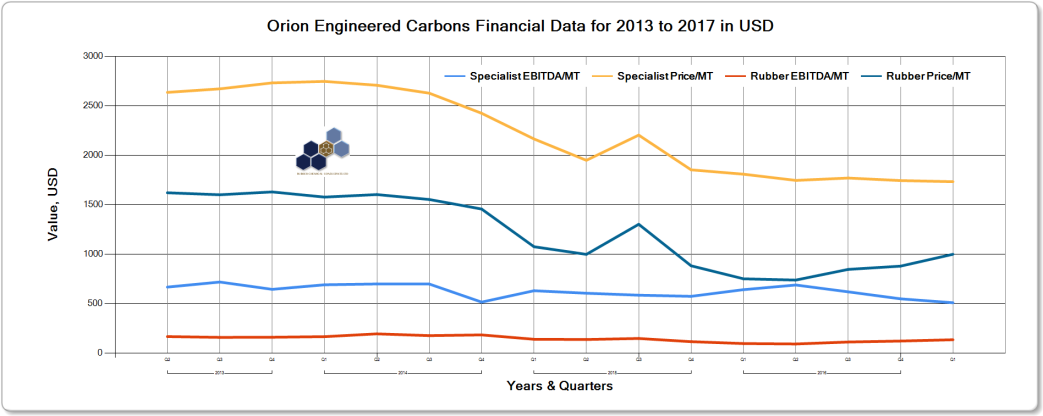

Orion Engineered Carbons USD: 2023 Q4 & FY Results Link...

Orion Engineered Carbons: Q4: Increased demand YoY in speciality and rubber (China). Revenue was flat due to lower pass through of oil prices, partially offset by improved pricing. Gross profit per MT down due to lower cogen pricing (European electricty pricing) and unfavourable product and geographic mix. FY: subdued demand in most markets excepting China. Lower revenue due to oil price pass through and volume, offset my contractual price increases. Gross profit increased due to negotiated contract pricing, offset by lower volumes and cogen revenue. Rubber Segment gross profit per MT increased due to contractual pricing. Speciality Segment gross profit per MT down due to geographic, product mix and cogen. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q4 | 468.2 | 462.1 | 1.3 | | | Carbon Black | adjEBITDA | Q4 | 66.6 | 65.2 | 2.1 | | | Carbon Black | EBITDA | Q4 | 59.4 | 61.8 | -3.9 | | | Carbon Black | EBIT | Q4 | 27.2 | 36.0 | -24.4 | | | Rubber Black | Sales Revenue | Q4 | 319.5 | 315.8 | 1.2 | | | Rubber Black | adjEBITDA | Q4 | 49.2 | 40.3 | 22.1 | | | Rubber Black | Sales Vol MT | Q4 | 171300.0 | 168400.0 | 1.7 | | | Specialist Black | Sales Revenue | Q4 | 148.7 | 146.3 | 1.6 | | | Specialist Black | adjEBITDA | Q4 | 17.4 | 24.9 | -30.1 | | | Specialist Black | Sales Vol MT | Q4 | 54900.0 | 46700.0 | 17.6 | |

Birla Carbon: ISCC Plus Certification for US and Korean Plants Link...

Birla Carbon's plants in Hickok, USA and Yeosu (South Korea) have secured ISCC Plus certification, this follows certification of Birla's Trecate, Italy plant last year. Birla Carbon is actively pursuing ISCC PLUS certification for several other global plants. The certification process for two units in Brazil and three units in India, Spain, Egypt, and Hungary is underway, with the remaining sites slated for completion through the remainder of CY 2024.

January (2024)

Orion Engineered Carbons: Completes EPA-Mandated Air Emissions Control Upgrades Link...

Orion has completed upgrading its air emissions control technology at all four of its U.S. carbon black plants – the biggest sustainability-related initiative in the company’s history. The company recently finished its final air emissions project at its plant in Belpre, Ohio. Previously, the company upgraded its Borger, Texas; Ivanhoe, Louisiana; and Orange, Texas, facilities.

Birla Carbon: Announces New Greenfield Expansions in India and Thailand Link...

Birla Carbon has announced that it will build two new manufacturing plants to support the fast growing markets of India and Southeast Asia. The plants will be built in Niadupet, Andhra Pradesh, India and Rayong, Thailand and will both have an intitial capacity of 120 kMT to be operational in 2025 with potential future expansions to 240 kMT. Previously announced brownfield expansion plans in Hungary, as well as, the post treatment facility expanding Specialty capacity at Patalganga, India, are progressing on plan.

Epsilon Carbon: Planning Integrated Carbon Complex in Odisha Link...

Epsilon Carbon has signed a MoU with the Government of Odisha committing an investment of Rs 10k crores over 10 years to establish an integrated carbon complex in Jharsuguda, Odisha. The ICC project includes carbon black capacity of 300 kMTpa as well as 500 kMT of speciality carbon and 75 kMT of advanced materials.

December (2023)

China Synthetic Rubber Corporation: 2023 Q3 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 4509.8 | 6110.9 | -26.2 | | | Carbon Black | EBIT | Q3 | -102.6 | 315.5 | -132.5 | |

November (2023)

Thai Carbon: 2023 Q2 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q2 | 3288.5 | 3255.0 | 1.0 | 1 | | Carbon Black | EBIT | Q2 | 1058.2 | 1665.8 | -36.5 | |

Orion Engineered Carbons: Celebrates Opening of 2nd Plant in China Link...

Orion has celebrated the opening of its new plant located in the city of Huaibei, Anhui province, China. The plant has 2 production lines with a total capacity of 70 kMTpa with production targetted at various segments including rubber, coatings, inks and plastics.

Tokai Group: 2023 Q3 Results Link...

Tokai Group: Carbon black revenue up YoY based on increased sales prices through the year. Q3 values indicate softening market. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 37300.0 | 39621.0 | -5.9 | 1 | | Carbon Black | EBIT | Q3 | 5152.0 | 4201.0 | 22.6 | |

Cabot Corporation: 2023 Q4 Results & FY2023 Link...

Cabot Corporation: FY 2023 results included: record EBIT in reinforcing materials driven by favourable CY2023 customer agreements in the face of a 5% volume decline due to prolonged destocking; Lower volumes in performance chemicals (except battery materials) due to an extended period of destocking and market weakness. Forward priorites include: Strategic investment in Battery Materials in US and EU; Expansion of reinforcement materials in Indonesia for Southeast Asia market growth; Debottlenecking of inkject capacity for packaging growth. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q4 | 850.0 | 950.0 | -10.5 | 1 | | Carbon Black | EBIT | Q4 | 160.6 | 145.2 | 10.6 | | | Rubber Black | Sales Revenue | Q4 | 624.0 | 700.0 | -10.9 | 2 | | Rubber Black | EBIT | Q4 | 134.0 | 109.0 | 22.9 | 3 | | Rubber Black | Sales Vol YoY % | Q4 | 98.0 | 104.0 | -5.8 | 4 | | Specialist Black | Sales Revenue | Q4 | 226.0 | 250.0 | -9.6 | 5 | | Specialist Black | EBIT | Q4 | 26.3 | 36.2 | -27.4 | |

Jiangxi Black Cat Carbon Black: 2023 Q3 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q3 | 2370.0 | 2648.9 | -10.5 | | | All Segments | Gross Margin | Q3 | 89.7 | 48.7 | 84.4 | | | All Segments | EBIT | Q3 | -26.4 | -21.2 | -24.6 | |

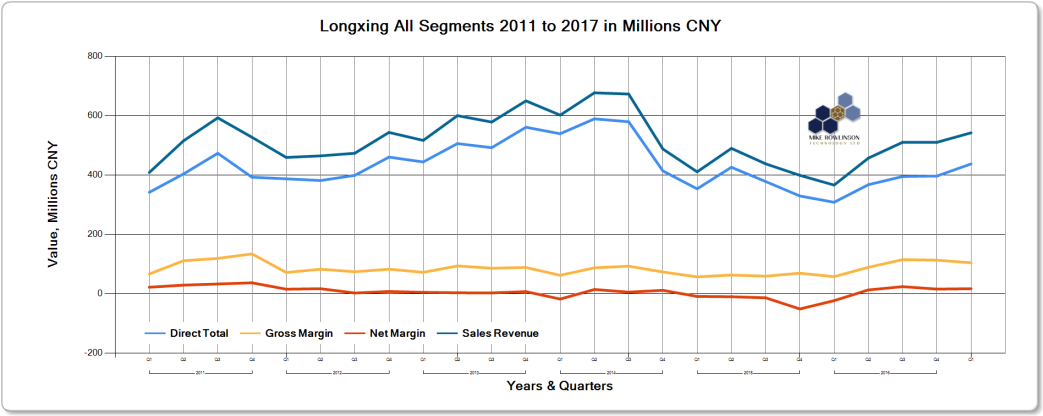

Longxing Chemical Stock: 2023 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q3 | 1041.5 | 1198.5 | -13.1 | | | All Segments | Gross Margin | Q3 | 121.1 | 92.7 | 30.7 | | | All Segments | EBIT | Q3 | 49.5 | 44.0 | 12.5 | |

Jinneng Science & Technology: 2023 Q3 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q3 | 3699.0 | 5276.0 | -29.9 | | | All Segments | Gross Margin | Q3 | 193.6 | 180.3 | 7.3 | | | All Segments | EBIT | Q3 | 67.2 | 100.8 | -33.3 | |

Yongdong Chemical Industry: 2023 Q3 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q3 | 1159.3 | 1231.6 | -5.9 | | | All Segments | Gross Margin | Q3 | 108.3 | 39.6 | 173.2 | | | All Segments | EBIT | Q3 | 74.0 | 3.3 | 2125.2 | |

Cabot Corporation: Launches New REPLASBLAK™ Circular Black Masterbatch Link...

Cabot has launched its new REPLASBLAK™ product family of circular black masterbatches with certified material. Part of Cabot's EVOLVE® Sustainable Solutions, the launch includes three products which will be sold as the company’s first-ever ISCC PLUS certified black masterbatch products:

- REPLASBLAK rePE5475 100% circular black masterbatch leverages 100% ISCC PLUS mass balance certified material made from reclaimed carbons from end-of-life tire pyrolysis and mechanically recycled polyethylene. It delivers more than 60% GHG reduction in comparison to a standard black masterbatch and adheres to the ISCC PLUS voluntary add-on GHG emissions requirements. This medium tint product is targetted at the automotive, agricultural, packaging and construction markets.

- REPLASBLAK rePE5265 70% circular black masterbatch leverages 70% ISCC PLUS mass balance certified material made from mechanically recycled polyethylene. It reduces GHG emissions by nearly 50% in comparison to a standard black masterbatch and adheres to the ISCC PLUS voluntary add-on GHG emissions requirements. This high gloss and high jet product is targetted at sheet extrusion applications in the automotive market.

- REPLASBLAK rePE5250 60% circular black masterbatch leverages 60% ISCC PLUS mass balance certified material made from mechanically recycled polyethylene. It reduces GHG emissions by nearly 50% in comparison to a standard black masterbatch and adheres to the ISCC PLUS voluntary add-on GHG emissions requirements. This high tint product is targetted at the automotive market.

Orion Engineered Carbons: 2023 Q3 Results Link...

Orion Engineered Carbons: Volumes flat with increases in China offset by lower volumes in EMEA and Americas. Gross profit down due to lower cogeneration and start-up of new facility in China. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q3 | 466.2 | 543.1 | -14.2 | | | Carbon Black | Gross Margin | Q3 | 110.2 | 114.4 | -3.7 | | | Carbon Black | adjEBITDA | Q3 | 77.3 | 80.5 | -4.0 | | | Carbon Black | EBITDA | Q3 | 73.6 | 78.8 | -6.6 | | | Carbon Black | EBIT | Q3 | 45.7 | 43.4 | 5.3 | | | Carbon Black | Sales Vol MT | Q3 | 245200.0 | 243300.0 | .8 | | | Rubber Black | Sales Revenue | Q3 | 315.8 | 373.5 | -15.4 | | | Rubber Black | Gross Margin | Q3 | 71.6 | 69.6 | 2.9 | 1 | | Rubber Black | adjEBITDA | Q3 | 51.2 | 49.4 | 3.6 | 2 | | Rubber Black | Sales Vol MT | Q3 | 185300.0 | 191000.0 | -3.0 | 3 | | Specialist Black | Sales Revenue | Q3 | 150.4 | 169.6 | -11.3 | | | Specialist Black | Gross Margin | Q3 | 38.6 | 44.8 | -13.8 | | | Specialist Black | adjEBITDA | Q3 | 26.1 | 31.1 | -16.1 | 4 | | Specialist Black | Sales Vol MT | Q3 | 59900.0 | 52300.0 | 14.5 | 5 |

Phillips Carbon Black Ltd: 2023 Q2 Results Link...

Phillips Carbon Black Ltd: Commissioned 84 kMTpa capacity at the new Chennai plant - completing phase I. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q2 | 13541.6 | 15913.0 | -14.9 | | | Carbon Black | EBIT | Q2 | 2045.1 | 1789.1 | 14.3 | | | Specialist Black | Sales Vol MT | Q2 | 15574.0 | 10016.0 | 55.5 | |

October (2023)

Birla Carbon: Acquires Nanocyl Link...

Birla Caron has completed the acquisition of Nanocyl SA, a worldwide leader in multi-wall carbon nanotubes (MWCNT’s) based in Sambreville, Belgium. The acquisition expands Birla Carbon’s presence in the Energy Systems market, with a focus on material critical to Lithium Ion battery performance along with other conductive applications. Nanocyl’s advanced MWCNTs enhances Birla's range of solutions for conductive applications, joining Birla's Conductex™ family of carbon black additives and active anode materials

China Synthetic Rubber Corporation: 2023 Q2 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q2 | 4067.1 | 5509.1 | -26.2 | | | Carbon Black | EBIT | Q2 | -293.4 | 7.6 | -3975.7 | |

September (2023)

Cabot Corporation: Increasing Prices Globally for Specialty Carbon Blacks Link...

Cabot is raising prices globally by up to 9% for specialty carbon blacks. The price increases are necessary to address higher costs associated with manufacturing relating to inflationary pressures, maintenance and environmental compliance costs. Increases are effective from November 1, 2023 or as contracts allow.

Cabot Corporation: Enhances Cirularity and Traceability Via ISCC Certification Link...

Cabot has achieved International Sustainability and Carbon Certification (ISCC) PLUS certification at six of its facilities. Sites currently certified include three reinforcing carbon facilities in Europe and the Americas as well as two masterbatch and compounding facilities* in Europe and the Company’s Europe, Middle East and Africa regional headquarters. Cabot currently offers two ISCC PLUS certified products powered by EVOLVE® Sustainable Solutions, VULCAN® 7H-C circular reinforcing carbon and STERLING® SO-RC110 circular reinforcing carbon. These products are produced via a mass balance approach designed to trace the flow of materials through a complex value chain.

Orion Engineered Carbons: Investing In Project for Circular Carbon Black Link...

Orion is investing 12.8 million Euro (including 6.4 million Euro funding from the German government and European Union) to further develop and demonstrate a climate-neutral process for producing carbon black from alternative sources. The technology is designed to improve Orion’s yield and throughput in the production of carbon black using circular feedstocks and thus potentially reduce the carbon footprint of the process by a significant amount. This could accelerate the shift to a circular economy and feed the growing demand for sustainable materials in the tire industry. A research facility is being built for the project at Orion’s main innovation center at its plant in Cologne.

August (2023)

Jinneng Science & Technology: 2023 Q2 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q2 | 3772.9 | 4306.7 | -12.4 | | | All Segments | EBIT | Q2 | 86.1 | 80.0 | 7.6 | | | All Segments | Net Margin | Q2 | 77.7 | 50.2 | 55.0 | |

Yongdong Chemical Industry: 2023 Q2 Results Link...

Yongdong Chemical Industry: First half of 2023 was subject to large fluctuations in raw material prices. Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q2 | 1053.0 | 1159.5 | -9.2 | | | All Segments | EBIT | Q2 | 1.2 | 47.1 | -97.6 | | | All Segments | Net Margin | Q2 | .2 | 40.0 | -99.5 | |

Thai Carbon: 2023 Q1 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | Q1 | 3089.7 | 3243.5 | -4.7 | 1 | | Carbon Black | EBIT | Q1 | 1190.0 | 1332.9 | -10.7 | |

Jiangxi Black Cat Carbon Black: 2023 Q2 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q2 | 2217.1 | 2806.7 | -21.0 | | | All Segments | EBIT | Q2 | -132.4 | 98.7 | -234.1 | | | All Segments | Net Margin | Q2 | -135.7 | 57.8 | -334.8 | |

Longxing Chemical Stock: 2023 Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | Q2 | 1036.7 | 1196.9 | -13.4 | | | All Segments | Net Margin | Q2 | 43.9 | 47.7 | -7.8 | | | All Segments | EBIT | Q2 | 41.2 | 58.1 | -29.1 | |

Orion Engineered Carbons USD: 2023 Q2 Results Link...

Orion Engineered Carbons: Speciality carbon black had reduced volumes (>10% reduction for quarter and half year) due to weakness in most end-markets leading to reduction in adjEBITDA. Pricing remained stable. Volumes in rubber carbon black were down 9.4% in the quarter and down 6.6% for the first half of 2023 due to the global economic slowdown. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/2 | 458.8 | 541.2 | -15.2 | | | Carbon Black | adjEBITDA | 2023/2 | 87.3 | 83.4 | 4.7 | | | Carbon Black | EBITDA | 2023/2 | 86.1 | 80.3 | 7.2 | | | Carbon Black | EBIT | 2023/2 | 58.9 | 52.9 | 11.3 | | | Carbon Black | Sales Vol MT | 2023/2 | 227300.0 | 251400.0 | -9.6 | | | Rubber Black | Sales Revenue | 2023/2 | 309.3 | 359.3 | -13.9 | 1 | | Rubber Black | adjEBITDA | 2023/2 | 57.4 | 38.0 | 51.1 | 2 | | Rubber Black | Sales Vol MT | 2023/2 | 173700.0 | 191700.0 | -9.4 | | | Specialist Black | Sales Revenue | 2023/2 | 149.5 | 181.9 | -17.8 | 3 | | Specialist Black | adjEBITDA | 2023/2 | 29.9 | 45.4 | -34.1 | 4 | | Specialist Black | Sales Vol MT | 2023/2 | 53600.0 | 59700.0 | -10.2 | |

Phillips Carbon Black Ltd: 2023 Q1 Results Link...

PCBL: Commissioned phase one (20 kMTpa) of speciality carbon black plant in Mundra in July following start-up (63 kMTpa) at the Tamil Nadu greenfield plant in April. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/1 | 12590.3 | 13739.0 | -8.4 | | | Carbon Black | EBIT | 2023/1 | 2042.3 | 1834.8 | 11.3 | | | Carbon Black | Sales Vol MT | 2023/1 | 118127.2 | 109377.0 | 8.0 | |

Tokai Group: 2023 Q2 Results Link...

Tokai Group: Demand remained constant, increased demand for OE tire and reduced for RP tire. Selling prices and margin improvements due to recovery of environmental investments, tight supply-demand in USMCA and other regions and higher productivity. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/2 | 36425.0 | 34299.0 | 6.2 | 1 | | Carbon Black | EBIT | 2023/2 | 5016.0 | 1736.0 | 188.9 | |

Cabot Corporation: Increasing Prices for Rubber Carbon Black Products Manufactured in USMCA Link...

Cabot is increasing prices for all carbon black products sold by its Reinforcement Materials segment in North America, effective for all shipments on or after October 1, 2023, or as customer contracts allow. The price increase will range from 6% to 9%, depending on product and packaging type. The price increases are deemed necessary to cover increasing operational and maintenance based manufacturing costs as well as to further Cabot's sustainability objectives for itself and its customers.

Cabot Corporation: 2023 Q3 Results Link...

Cabot Corporation: Lower replacement tire demand impacted reinforcement volumes across all regions. Specialist black impacted due to market weakness with key end markets remaining challenging. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/3 | 851.0 | 977.0 | -12.9 | | | Carbon Black | EBIT | 2023/3 | 155.6 | 158.7 | -2.0 | | | Rubber Black | Sales Revenue | 2023/3 | 624.0 | 707.0 | -11.7 | 1 | | Rubber Black | EBIT | 2023/3 | 132.0 | 113.0 | 16.8 | 2 | | Rubber Black | Sales Vol YoY % | 2023/3 | 92.0 | 105.0 | -12.4 | | | Specialist Black | Sales Revenue | 2023/3 | 227.0 | 270.0 | -15.9 | 3 | | Specialist Black | EBIT | 2023/3 | 23.6 | 45.7 | -48.3 | | | Specialist Black | Sales Vol YoY % | 2023/3 | 92.0 | 102.0 | -9.8 | 4 |

Cabot Corporation: Joins US DOE's Better Plants Program Link...

Cabot has announced its partnership with the U.S. Department of Energy’s (DOE’s) Better Plants program. The voluntary partnership program aims to drive significant energy efficiencies across the US industrial sector. Cabot sees this as an opportunity to advance its energy efficiency performance twoards is net zero emissions goal by 2050. All of Cabot's current U.S.-based manufacturing sites are part of the program. The Better Plants program currently has more than 280 partners representing every major U.S. industrial sector and includes more than 3,600 facilities across the U.S. Through the initiative, partners share proven energy-efficiency strategies and best practices. Cabot anticipates being able to apply lessons learned from the partnership to help advance its energy efficiency improvement activities in the U.S. The Better Plants program works with leading U.S. manufacturers to set ambitious environmental goals and commit to reducing energy intensity by 25% over a 10-year period across all U.S. operations. By partnering with industry, the Better Plants program aims to help leading manufacturers boost efficiency, increase resilience, strengthen economic competitiveness and reduce their carbon footprint through improvements in energy efficiency.

May (2023)

China Synthetic Rubber Corporation: 2023 Q1 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/1 | 4410.8 | 4889.4 | -9.8 | | | Carbon Black | EBIT | 2023/1 | 103.8 | 88.0 | 17.9 | |

Phillips Carbon Black Ltd: 2022 Full Year Results Link...

PCBL: Best ever financial performance for FY23 despite strong global economic headwinds and volatility. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/4 | 13351.2 | 11921.3 | 12.0 | | | Carbon Black | EBIT | 2022/4 | 1691.7 | 1386.3 | 22.0 | | | Carbon Black | Sales Vol MT | 2022/4 | 119238.0 | 113122.0 | 5.4 | |

Tokai Group: 2023 Q1 Results Link...

Tokai Group: Demand for tires remained solid. Costs of capital investments for production emissions control were offset by strong U.S. demand. Operations were at full capacity at bases in Japan and Thailand. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/1 | 37406.0 | 29430.0 | 27.1 | 1 | | Carbon Black | EBIT | 2023/1 | 5757.0 | 3049.0 | 88.8 | |

Cabot Corporation: 2023 Q2 Results Link...

Cabot Corporation: Reinforcing margins improved due to favourable pricing and mix for 2023 customer agreements. Volumes down in reinforcing and performance chemicals due to COVID outbreaks in China, with performance chemicals also impacted by market softness. Volume growth continues in Battery Materials. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/2 | 913.0 | 893.0 | 2.2 | 1 | | Carbon Black | EBIT | 2023/2 | 142.7 | 152.7 | -6.6 | | | Rubber Black | Sales Revenue | 2023/2 | 672.0 | 627.0 | 7.2 | | | Rubber Black | EBIT | 2023/2 | 122.0 | 101.0 | 20.8 | | | Rubber Black | Sales Vol YoY % | 2023/2 | 93.0 | 103.0 | -9.7 | 2 | | Specialist Black | Sales Revenue | 2023/2 | 241.0 | 266.0 | -9.4 | 3 | | Specialist Black | EBIT | 2023/2 | 20.7 | 51.7 | -60.0 | | | Specialist Black | Sales Vol YoY % | 2023/2 | 95.0 | 102.7 | -7.5 | 4 |

Orion Engineered Carbons USD: 2023 Q1 Results Link...

Orion Engineered Carbons: Record 2023 Q1 adjEBITDA. Borger, Texas emissions project completed, final emissions project on track for 2H 2023. Huabei, China plant commissioned and producing qualificationi samples, full ramp up in 2024. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/1 | 500.7 | 484.5 | 3.3 | | | Carbon Black | EBIT | 2023/1 | 73.5 | 54.6 | 34.6 | | | Carbon Black | Sales Vol MT | 2023/1 | 233500.0 | 253200.0 | -7.8 | | | Rubber Black | Sales Revenue | 2023/1 | 338.7 | 306.9 | 10.4 | | | Rubber Black | adjEBITDA | 2023/1 | 63.8 | 40.7 | 56.8 | | | Rubber Black | Sales Vol MT | 2023/1 | 180500.0 | 187600.0 | -3.8 | | | Specialist Black | Sales Revenue | 2023/1 | 162.0 | 177.6 | -8.8 | | | Specialist Black | adjEBITDA | 2023/1 | 37.3 | 42.5 | -12.2 | | | Specialist Black | Sales Vol MT | 2023/1 | 53000.0 | 65600.0 | -19.2 | |

Jiangxi Black Cat Carbon Black: 2023 Q1 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2023/1 | 2206.2 | 1848.7 | 19.3 | | | All Segments | Direct Total | 2023/1 | 2190.7 | 1792.7 | 22.2 | | | All Segments | Gross Margin | 2023/1 | 15.5 | 56.0 | -72.2 | | | All Segments | EBIT | 2023/1 | -104.1 | .7 | -14916.3 | |

Yongdong Chemical Industry: 2023 Q1 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2023/1 | 1138.8 | 848.5 | 34.2 | | | All Segments | Direct Total | 2023/1 | 1097.4 | 803.4 | 36.6 | | | All Segments | Gross Margin | 2023/1 | 41.3 | 45.2 | -8.6 | | | All Segments | Net Margin | 2023/1 | -4.5 | 10.6 | -143.0 | | | All Segments | EBIT | 2023/1 | -5.1 | 12.3 | -141.5 | |

Jinneng Science & Technology: 2023 Q1 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2023/1 | 3441.8 | 4518.5 | -23.8 | | | All Segments | Net Margin | 2023/1 | -138.7 | 124.1 | -211.8 | | | All Segments | EBIT | 2023/1 | -162.4 | 151.1 | -207.5 | |

April (2023)

Jinneng Science & Technology: 2022 Q4 Results Link...

Jinneng Science & Technology Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/4 | 2699.4 | 4056.6 | -33.5 | | | All Segments | Net Margin | 2022/4 | -10.8 | -196.0 | 94.5 | | | All Segments | EBIT | 2022/4 | -88.8 | -193.9 | 54.2 | |

Longxing Chemical Stock: 2023 Q1 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2023/1 | 1119.5 | 1003.3 | 11.6 | | | All Segments | EBIT | 2023/1 | 17.9 | 14.3 | 25.3 | | | All Segments | Net Margin | 2023/1 | 12.7 | 11.4 | 11.6 | |

Phillips Carbon Black Ltd: Successfully Commissioned Phase One of Its Chennai Plant Link...

PCBL have successfully commissioned the first phase of its greenfield plant in Chennai, India. The first phase has a capacity of 63 kMTpa. When fully complete the plant will have a capacity of 147 kMTpa and 24 MW of green power.

Asahi (Bridgestone): Acquires ISCC PLUS Certification Link...

Asahi Carbon Co., Ltd. has acquired ISCC PLUS certification and plans to start producing carbon black using recycled oil as a raw material starting August 2023. This approach enables the selling of carbon black produced using sustainable recycled resources using a mass balance method defined by ISCC PLUS.

March (2023)

Orion Engineered Carbons: Increases Capacity for High-Jetness Carbon Blacks at Cologne Plant Link...

Orion Engineered Carbons has debottlenecked a post-treatment unit at its Cologne, Germany, plant that produces high-jetness specialty carbon blacks. This enables Orion to increase production capacity and also produce pelleted product in addition to powder. High-jetness carbon blacks deliver a deep black masstone with a bluish undertone and are popular in automotive coatings. Orion has plans to install a second post-treatment unit at its Cologne facility due to the rapidly growing demand for the company’s premium grades.

Cabot Corporation: Launches EVOLVE™ Sustainable Solutions Link...

Cabot has announced its EVOLVE™ sustainable solutions technology platform which develops reinforcing carbons in three sustainability categories:

- Recovered

- Reinforcing carbons leveraging circular value chains and materials recovered from end-of-life tires

- Renewable

- Reinforcing carbons from bio-based feedstocks and particles

- Reduced

- Reinforcing carbons with a reduced greenhouse gas footprint

The first EVOLVE™ product offerings are: Vulcan 7H-C circular reinforcing carbon black, an N234 carbon black made from ISCC PLUS certified tire pyrolysis oil which is a drop-in replacement for standard Vulcan 7H; and Sterling® SO-RC110 circular reinforcing carbon black produced using 10% ISCC PLUS recovered carbon material co-pelletised with Sterling SO carbon black (N550). Sterling SO-RC110 offers equivalent performance to Sterling SO.

February (2023)

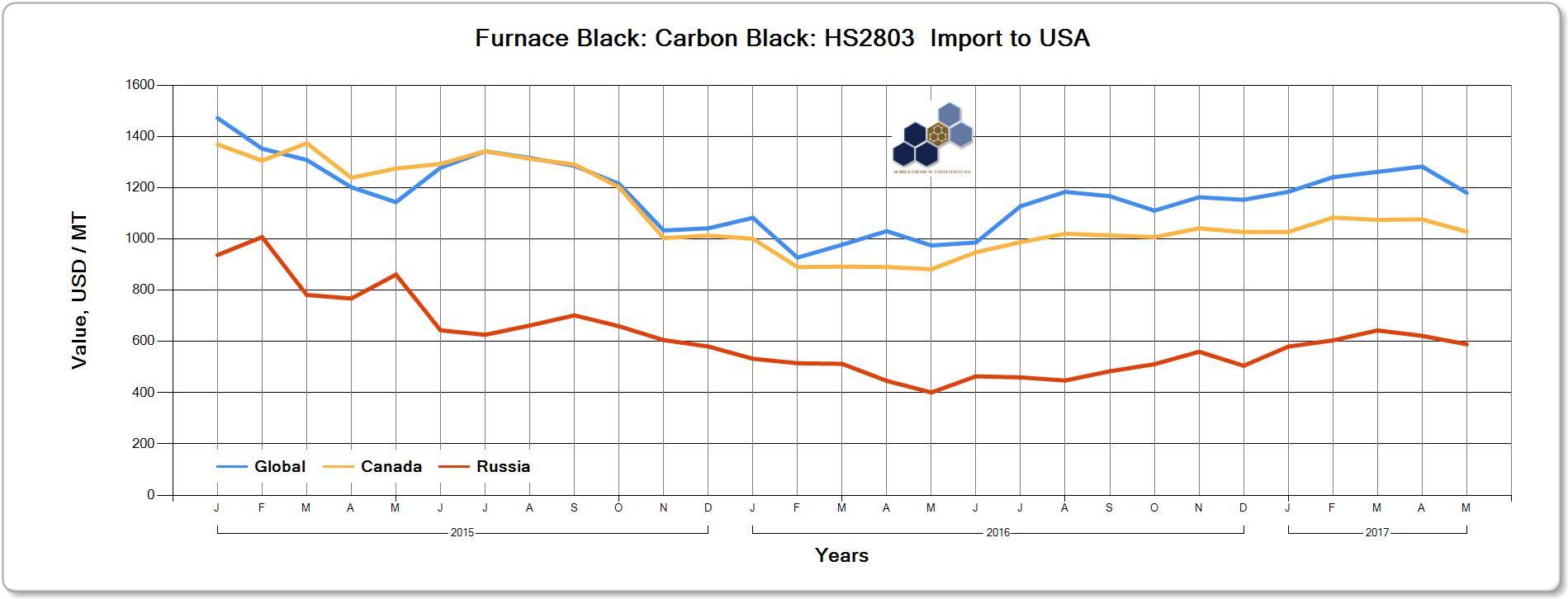

EU Commission: 10th Package of Sanctions Against Russia Including Carbon Black Link...

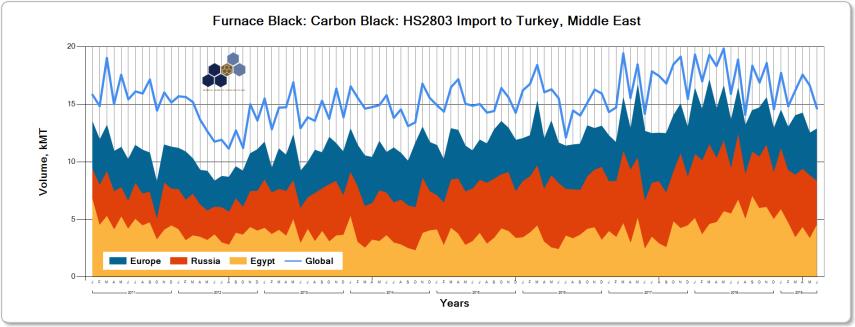

The EU has implemented (February 25th 2023) an import quota of 752.5 kMT of Russian carbon black which will expire after June 30th, 2024. From this date an import embargo with be in effect.

Thai Carbon: 2022 Q3 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 2918.7 | 2709.3 | 7.7 | | | Carbon Black | EBIT | 2022/3 | -831.0 | 285.2 | -391.4 | |

China Synthetic Rubber Corporation: 2022 Q4 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/4 | 5215.1 | 4646.8 | 12.2 | | | Carbon Black | EBIT | 2022/4 | -71.8 | 83.3 | -186.2 | |

Orion Engineered Carbons USD: 2022 Q4 Results Link...

Orion Engineered Carbons: Reduction in speciality volumes offset partially by growth in rubber volumes (Americas and APAC). Improved contribution by cogeneration. Huaibei plant currently being commissioned with full ramp-up by 2025. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/4 | 462.1 | 392.7 | 17.7 | | | Carbon Black | adjEBITDA | 2022/4 | 65.2 | 52.3 | 24.7 | | | Carbon Black | EBIT | 2022/4 | 36.0 | 12.9 | 179.1 | | | Carbon Black | Sales Vol MT | 2022/4 | 215100.0 | 223100.0 | -3.6 | | | Rubber Black | Sales Revenue | 2022/4 | 315.8 | 245.1 | 28.8 | | | Rubber Black | adjEBITDA | 2022/4 | 40.3 | 22.0 | 83.2 | | | Rubber Black | Sales Vol MT | 2022/4 | 168400.0 | 163300.0 | 3.1 | | | Specialist Black | Sales Revenue | 2022/4 | 146.3 | 147.6 | -.9 | | | Specialist Black | adjEBITDA | 2022/4 | 24.9 | 30.3 | -17.8 | | | Specialist Black | Sales Vol MT | 2022/4 | 46700.0 | 59800.0 | -21.9 | |

Tokai Group: 2022 Q4 Results Link...

Tokai Group: Softening of volumes also impacted by sale of Tokai Carbon and installation of environmental equipment in US. Volumes expected to recover in the next quarter and year. Sales revenue increase due to pass-on of feedstock and energy costs. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/4 | 35134.0 | 27229.0 | 29.0 | 1 | | Carbon Black | EBIT | 2022/4 | 3296.0 | 2099.0 | 57.0 | |

Cabot Corporation: 2023 Q1 Results Link...

Cabot Corporation: Reinforcing volumes down 5% YoY due to customer destocking and COVID-19 outbreaks in China. Margins improved due to favourable pricing and product mix for 2022 customer agreements. Performance chemicals volumes down 8% driven by destocking, market softness and COVID outbreaks in China. Volumes for both segments are expected to improve moving into Q2 FY 2023. Growth in battery materials remains strong. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2023 | 2022 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2023/1 | 854.0 | 768.0 | 11.2 | 1 | | Carbon Black | EBIT | 2023/1 | 115.4 | 124.1 | -7.0 | | | Rubber Black | Sales Revenue | 2023/1 | 643.0 | 541.0 | 18.9 | | | Rubber Black | EBIT | 2023/1 | 94.0 | 85.0 | 10.6 | | | Rubber Black | Sales Vol YoY % | 2023/1 | 95.0 | 104.0 | -8.7 | | | Specialist Black | Sales Revenue | 2023/1 | 211.0 | 227.0 | -7.0 | 2 | | Specialist Black | EBIT | 2023/1 | 21.4 | 39.1 | -45.2 | | | Specialist Black | Sales Vol YoY % | 2023/1 | 92.0 | 97.0 | -5.2 | |

Phillips Carbon Black Ltd: 2022 Q3 Results Link...

PCBL: Volumes down due to customers using up inventory in anticipation of formula pricing drops in the next quarter. Q4 volumes are expected to balance this out. High profit margin for power generation. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 13314.3 | 11283.1 | 18.0 | | | Carbon Black | EBIT | 2022/3 | 1671.9 | 1455.1 | 14.9 | | | Carbon Black | Sales Vol MT | 2022/3 | 92000.0 | 115924.0 | -20.6 | |

January (2023)

Cabot Corporation: Investing in U.S. Conductive Carbon Additives Capacity for Electric Vehicle Applications Link...

Cabot plans to add conductive carbon additives (CCA) capacity in the United States to support the transition to electric vehicles (EVs). Cabot plans to add conductive carbons capacity at its existing facility in Pampa, Texas, which is part of an approximately $200 million planned investment program over the next five years focused on expanding the company’s CCA production in the United States. CCAs are an essential component of lithium-ion battery chemistry and are used to provide sufficient electrical conductivity to the active materials. Cabot has the broadest portfolio of CCAs including conductive carbons, carbon nanotubes (CNT), carbon nanostructures (CNS), and blends of CCAs to deliver optimal performance. Additionally, the company’s global footprint of manufacturing assets, technology labs and commercial resources enables regional supply security support for its customers. Cabot expects to invest approximately $75-90 million to produce 15 kMTpa of conductive carbons at its existing facility in Pampa, TX. The project is expected to commence operations at the end of calendar year 2025. In addition to a manufacturing plant, Cabot also operates a research and development facility and pilot plant in Pampa that focuses on developing new process technology for battery and other applications.

Orion Engineered Carbons: Reduces Air Emissions at Borger, Texas Plant Link...

Orion Engineered Carbons (OEC) has reduced air emissions at its Borger, Texas plant with new control technology. The emissions technology provides a major improvment in air quality by eliminating 23 tons/day of nitrogen oxide and sulphur dioxide emissions, which is a 90% reduction.The $60 million project also upgraded the site's cogeneration system. OEC also recently upgraded emissions control technology at is plants in Ivanhoe, La and Orange, Texas and plans finish its final U.S. emissions project at its Belpre, Ohio plant later this year.

China Synthetic Rubber Corporation: Confirmed Closure of Continental Carbon Phenix City Plant Link...

The closure of Continental Carbon's Phenix City plant has been confirmed. The company was ordered to close the facility by the Alabama Department of Environmental Management for failure to institute mandated plant upgrades to meet U.S. EPA Clean Air Act standards.

December (2022)

China Synthetic Rubber Corporation: Continental Carbon Phenix City, USA Plant Set for Closure Link...

Continental Carbon's plant in Phenix City, Alabama will cease operations at the end of this month after failing to implement mandatory environmental upgrades at the facility. Continental had asked for an extension to the completion schedule from the US EPA, however, no grace period is to be granted. If there are no further developments operations will cease January 1st 2023.

November (2022)

Thai Carbon: 2022 Q2 Results Link...

Thai Carbon: Strong performance from pricing benefits. Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/2 | 3255.0 | 2224.9 | 46.3 | 1 | | Carbon Black | EBIT | 2022/2 | 448.0 | 381.8 | 17.3 | 2 |

China Synthetic Rubber Corporation: 2022 Q3 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 6110.9 | 4541.2 | 34.6 | | | Carbon Black | EBIT | 2022/3 | 315.5 | 114.2 | 176.3 | |

Cabot Corporation: 2022 Q4 Results Link...

Cabot Corporation: Significant progress in key investments during 2022 focusing on battery material capacity and sales growth with a 58% volume growth in battery material sales during FY 2022. Reinforcing materials showed a 63% YoY EBIT improvement based on strong volume growth, better pricing and product mix. Successful implementation of price increases across the performance segment to recover rising costs. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/4 | 950.0 | 694.0 | 36.9 | 1 | | Carbon Black | EBIT | 2022/4 | 145.2 | 98.8 | 46.9 | | | Rubber Black | Sales Revenue | 2022/4 | 700.0 | 493.0 | 42.0 | | | Rubber Black | EBITDA | 2022/4 | 126.0 | 85.0 | 48.2 | | | Rubber Black | EBIT | 2022/4 | 109.0 | 67.0 | 62.7 | | | Rubber Black | Sales Vol YoY % | 2022/4 | 104.0 | 106.0 | -1.9 | 2 | | Specialist Black | Sales Revenue | 2022/4 | 250.0 | 201.0 | 24.4 | 3 | | Specialist Black | EBITDA | 2022/4 | 49.6 | 44.6 | 11.1 | | | Specialist Black | EBIT | 2022/4 | 36.2 | 31.8 | 13.8 | | | Specialist Black | Sales Vol YoY % | 2022/4 | 103.0 | 102.0 | 1.0 | |

Tokai Group: 2022 Q3 Results Link...

Tokai Group: Sales volumes decreased YoY due to sale of Tokai Carbon (Tianjin). Environmental equipment at US production plants will be fully implemented by end of 2022 followed by full operation in 2023. Sales revenue increased due to high selling price with FS cost pass through.

Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 39621.0 | 25998.0 | 52.4 | | | Carbon Black | EBIT | 2022/3 | 4201.0 | 2331.0 | 80.2 | |

Jiangxi Black Cat Carbon Black: 2022 Q3 Results Link...

Jiangxi Black Cat Carbon Black: Investing in new 20k Mtpa speciality super conducting carbon black plant, Leping City, Jiangxi. Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/3 | 2648.9 | 1855.9 | 42.7 | | | All Segments | EBIT | 2022/3 | -21.2 | 19.6 | -208.4 | | | All Segments | Net Margin | 2022/3 | -30.9 | 10.0 | -410.4 | |

Longxing Chemical Stock: 2022 Q3 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/3 | 1198.5 | 809.1 | 48.1 | | | All Segments | EBIT | 2022/3 | 44.0 | 18.0 | 144.2 | | | All Segments | Net Margin | 2022/3 | 34.8 | 19.0 | 82.5 | |

Jinneng Science & Technology: 2022 Q3 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/3 | 5276.0 | 2707.5 | 94.9 | | | All Segments | EBIT | 2022/3 | 100.8 | 232.5 | -56.7 | | | All Segments | Net Margin | 2022/3 | 85.7 | 208.1 | -58.8 | |

Yongdong Chemical Industry: 2022 Q3 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/3 | 1231.6 | 942.8 | 30.6 | | | All Segments | EBIT | 2022/3 | 3.3 | 39.1 | -91.5 | | | All Segments | Net Margin | 2022/3 | 3.0 | 32.8 | -90.7 | |

Orion Engineered Carbons USD: 2022 Q3 Results Link...

Orion Engineered Carbons: Ahead of plan on natural gas reduction in Europe. Successful 2023/4 contract negotiations. New plant in Huaibei, China on track for early 2023 startup. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 543.1 | 393.1 | 38.2 | 1 | | Carbon Black | Gross Margin | 2022/3 | 114.4 | 98.7 | 15.9 | 2 | | Carbon Black | adjEBITDA | 2022/3 | 80.5 | 66.4 | 21.2 | 3 | | Carbon Black | EBITDA | 2022/3 | 78.8 | 64.1 | 22.9 | | | Carbon Black | EBIT | 2022/3 | 43.4 | 40.3 | 7.7 | | | Rubber Black | Sales Revenue | 2022/3 | 373.5 | 242.8 | 53.8 | 4 | | Rubber Black | Gross Margin | 2022/3 | 69.6 | 47.1 | 47.8 | 5 | | Rubber Black | adjEBITDA | 2022/3 | 49.4 | 27.4 | 80.4 | | | Rubber Black | Sales Vol MT | 2022/3 | 191000.0 | 173000.0 | 10.4 | | | Specialist Black | Sales Revenue | 2022/3 | 169.6 | 150.2 | 12.9 | 6 | | Specialist Black | Gross Margin | 2022/3 | 44.8 | 51.6 | -13.2 | | | Specialist Black | adjEBITDA | 2022/3 | 31.1 | 39.0 | -20.3 | | | Specialist Black | Sales Vol MT | 2022/3 | 52300.0 | 63900.0 | -18.2 | |

Phillips Carbon Black Ltd: 2022 Q2 Results Link...

PCBL: Short-term market uncertainties prevail. Domestic market is growing in line with the automotive industry, however, increased domestic capacities may have a negative effect in the short-term. Export demand has reduced primarily due to disruption in the global market, particulary relevant for exports to Europe. Continuing consolidation in the Chinese carbon black industry along with geopolitical issues influencing oil and FX rates make the foreseeable situation extremely volatile. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/2 | 15913.0 | 10451.7 | 52.3 | | | Carbon Black | EBIT | 2022/2 | 1789.1 | 1678.4 | 6.6 | | | Power | Sales Revenue | 2022/2 | 560.5 | 430.2 | 30.3 | | | Power | EBIT | 2022/2 | 363.6 | 249.0 | 46.0 | |

Orion Engineered Carbons: Earns ISCC Plus Certification for Multiple Grades and Plants Link...

Orion Engineered Carbons has become the first major carbon black producter to achieve International Sustainability and Carbon Certifications (ISCC Plus) for multiple carbon black grades made from different feedstocks at plants in two regions of the world. The ISCC PLUS certification involved rigorous audits of Orion’s plants and processes that confirmed the company’s compliance with high sustainability requirements. It also verified the transparency and traceability of sustainable raw materials in the company’s value chain at three plants producing the concerned grades of carbon black. The ISCC PLUS certified products include the ECORAX® Circular grades produced in Borger, Texas, and Belpre, Ohio, using pyrolysis oils from end-of-life tires. Also covered is ECORAX® Nature 200, produced in Jaslo, Poland, and based on bio-circular feedstocks. Significantly, the certified products are similar to conventional grades and are “drop-ins” that require minimal reformulation in the complex rubber compounds used by our major tire manufacturing customers.

October (2022)

Cabot Corporation: Expands Engineered Elastomer Composites (E2C™) Portfolio Link...

Cabot Corporation has announced the expansion of its Engineered Elastomer Composites (E2C™) product line with the launch of two new products, E2C™ FX9570 and E2C™ EX9620 solutions. These solutions provide rubber manufacturers with additional options to design products for high durability in demanding operating environments. Furthermore, they deliver improvements in durability and heat minimization that have benefits in off-the-road tires like aircraft and port tires, truck tires used on rough surfaces, as well as in other industrial rubber products exposed to severe wear conditions or high operating temperatures. The E2C solutions family includes three performance series – Durability, Efficiency and Foundation. The E2C EX9620 product is the first solution released in the Efficiency series and is designed to enable cool-running rubber compounds with strong resistance to abrasion and cutting. EX9620 is optimally deployed in applications where rubber products are subject to excessive heat loads caused by high operating speeds, heavy loads, long duty cycles and/or high temperatures. The E2C FX9570 product is part of the Foundation series and enables high rubber durability in rough environments where cutting and chipping is prevalent, and duty cycles demand higher heat resistance. FX9570 lowers heat build-up by up to 20% versus conventional compounds.

Cabot Corporation: Increasing Speciality Carbon Prices Globally Link...

Cabot is raising prices globally for all shipments of speciality carbon blacks from 6th November 2022, or as contracts allow.The increase is required due to the rise in raw material and production related costs. Increases and timing will vary by region and product.

September (2022)

Tokai Group: Constructing New Carbon Black Plant in Thailand Link...

Tokai's board has approved the construction of a new carbon black plant (replacing the existing site) in Thailand. The demand for carbon black in the region has increased significantly in recent years due to the expansion of the automotive industry. The new plant will have a capacity of 180 kMTpa and is scheduled for completion April 2025 (pending various approvals).

Yongdong Chemical Industry: 2022 Q2 Results Link...

Yongdong Chemical Industry is active in coal tar processing and carbon black production. Carbon black production includes reinforcing, conductive and pigment grades of carbon black. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/2 | 1159.5 | 952.1 | 21.8 | | | All Segments | EBIT | 2022/2 | 47.1 | 123.8 | -62.0 | | | All Segments | Net Margin | 2022/2 | 40.0 | 104.8 | -61.8 | |

Longxing Chemical Stock: 2022 Q2 Results Link...

Longxing Chemical Stock (second largest furnace carbon black producer in China) also produces chemicals and precipitated silica. Rubber Chemical Consultants tracks Longxing's furnace black and precipitated silica segments as well as quarterly company results. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/2 | 1196.9 | 858.0 | 39.5 | | | All Segments | EBIT | 2022/2 | 58.1 | 53.4 | 8.8 | | | All Segments | Net Margin | 2022/2 | 47.7 | 43.2 | 10.3 | |

August (2022)

Jiangxi Black Cat Carbon Black: 2022 Q2 Results Link...

Jiangxi Black Cat Carbon Black is China's biggest producer of furnace carbon black with capacity at just over 1 million metric tonnes. Rubber Chemical Consultants tracks Jiangxi Black Cat for total financial performance as well as performance in furnace black and precipitated silica production. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/2 | 2806.7 | 2100.5 | 33.6 | | | All Segments | EBIT | 2022/2 | 98.7 | 223.5 | -55.8 | | | All Segments | Net Margin | 2022/2 | 57.8 | 185.0 | -68.8 | |

Jinneng Science & Technology: 2022 Q2 Results Link...

Jinneng Science & Technology have an integrated chemical operation including coking, chemical production, coal tar deep processing, carbon black and silica production. RCCL follows Jinneng's full operational results (all segments) and studies individual carbon black and silica segment performance. Currency values reported in: Millions of CNY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/2 | 4306.7 | 2638.0 | 63.3 | | | All Segments | EBIT | 2022/2 | 80.0 | 530.5 | -84.9 | | | All Segments | Net Margin | 2022/2 | 50.2 | 447.4 | -88.8 | |

Thai Carbon: 2022 Q1 Results Link...

Thai Carbon report in one segment: Carbon Black. Currency values reported in: Millions of THB | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/1 | 3243.5 | 2074.2 | 56.4 | | | Carbon Black | EBIT | 2022/1 | 439.6 | 400.9 | 9.7 | 1 |

China Synthetic Rubber Corporation: 2022 Q2 Results Link...

China Synthetic Rubber Corporation (CSRC) manufacture furnace carbon black, biotech and electronic products. Rubber Chemical Consultants Ltd tracks the Carbon Black segment which accounts for approximately two thirds of CSRC's total sales revenue (2016). Currency values reported in: Millions of TWD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/2 | 5509.1 | 4164.4 | 32.3 | | | Carbon Black | EBIT | 2022/2 | 7.6 | 82.4 | -90.8 | |

Orion Engineered Carbons USD: 2022 Q2 Results Link...

Orion Engineered Carbons: Achieved record adjusted EBITDA and gross profit per ton. Gains via pass through of higher feedstock costs combined with price realisation and improved product mix (especially in the speciality segment). Favourable growth and market outlook in North America and Europe. Completion of the gas black capacity expansion is expected early 2023. Orion Engineered Carbons manufactures furnace carbon black as well as thermal, gas, lampblack and acetylene blacks and is the third largest carbon black producer on a global basis. Orion reports results in two segments: Specialist and Rubber. Rubber Chemical Consultants tracks the two segments as well as the overall company results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/2 | 541.2 | 401.0 | 35.0 | | | Carbon Black | adjEBITDA | 2022/2 | 83.4 | 78.8 | 5.8 | | | Carbon Black | EBITDA | 2022/2 | 80.3 | 158.0 | -49.2 | | | Carbon Black | EBIT | 2022/2 | 52.9 | 132.0 | -59.9 | | | Carbon Black | Sales Vol MT | 2022/2 | 251400.0 | 250300.0 | .4 | | | Rubber Black | Sales Revenue | 2022/2 | 359.3 | 244.7 | 46.8 | 1 | | Rubber Black | adjEBITDA | 2022/2 | 38.0 | 39.5 | -3.8 | 2 | | Rubber Black | Sales Vol MT | 2022/2 | 191700.0 | 182200.0 | 5.2 | | | Specialist Black | Sales Revenue | 2022/2 | 181.9 | 156.2 | 16.5 | 3 | | Specialist Black | adjEBITDA | 2022/2 | 45.4 | 39.3 | 15.5 | 4 | | Specialist Black | Sales Vol MT | 2022/2 | 59700.0 | 68100.0 | -12.3 | |

Cabot Corporation: 2022 Q3 Results Link...

Cabot Corporation: Reinforcement materials EBIT at record high driven by volume growth and improved customer agreements for pricing. Momentum in battery materials continues with a 60% YoY volume growth - Xuzhou facility commenced production in Q3 and Tianjin first phase upgrades are on track. Zuhai CNT dispersion capacity expansion completed. Cabot Corporation operate in four segments: Reinforcement Materials, Performance Chemicals, Purification Solutions and Speciality Fluids. RCCL tracks performance in the Reinforcement Materials (rubber carbon blacks) and Performance Chemicals (specialist carbon blacks, plastic compounds, metal oxides). EBIT/EBITDA figures for carbon black in the performance chemical segment use RCCL estimates. RCCL also estimates performance for total carbon black based on annual results. Currency values reported in: Millions of USD | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/3 | 977.0 | 687.0 | 42.2 | 1 | | Carbon Black | EBIT | 2022/3 | 158.7 | 122.1 | 30.0 | | | Rubber Black | Sales Revenue | 2022/3 | 707.0 | 479.0 | 47.6 | 2 | | Rubber Black | EBITDA | 2022/3 | 130.0 | 102.0 | 27.5 | | | Rubber Black | EBIT | 2022/3 | 113.0 | 85.0 | 32.9 | | | Specialist Black | Sales Revenue | 2022/3 | 270.0 | 208.0 | 29.8 | 3 | | Specialist Black | EBITDA | 2022/3 | 58.8 | 49.4 | 18.9 | | | Specialist Black | EBIT | 2022/3 | 45.7 | 37.1 | 23.4 | 4 | | Specialist Black | Sales Revenue | 2022/3 | 270.0 | 208.0 | 29.8 | 5 | | Specialist Black | EBITDA | 2022/3 | 58.8 | 49.4 | 18.9 | | | Specialist Black | EBIT | 2022/3 | 45.7 | 37.1 | 23.4 | 6 |

Tokai Group: 2022 Q2 Results Link...

Tokai Group: Carbon black operations at full capacity in Japan, Thailand and Canada due to recovery in demand for auto and tire production. Supply of carbon black is becoming increasingly tight, especially in the U.S. Tokai will continue to invest in facility upgrades and environmental facilities to ensure a stable supply. Tokai Carbon Co Ltd operates in five reporting segments one of which is carbon black. Tokai carbon produce carbon black in Japan, Thailand and China. Tokai acquired Cancarb (which produces thermal carbon black) in 2014 and also acquired Sid Richardson (a furnace carbon black manufacturer with three US production facilities) mid 2018. RCCL tracks Tokai's carbon black segment. Currency values reported in: Millions of JPY | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| Carbon Black | Sales Revenue | 2022/2 | 34299.0 | 24669.0 | 39.0 | 1 | | Carbon Black | EBIT | 2022/2 | 1736.0 | 2546.0 | -31.8 | 2 |

July (2022)

Phillips Carbon Black Ltd: 2022 Q1 Results Link...

PCBL: Global demand for speciality blacks is increasing and PCBL is taking advantage of this with extended global reach and new customers. Despite significant crude price increases PCBL has improved EBITDA/MT due to the positive market demand situation as well as good performance in power and speciality blacks. Phillips Carbon Black Ltd (PCBL) produce furnace carbon black and also cogenerate electricity using the waste gas from the carbon black process. PCBL report in two segments: Carbon Black and Power, the Power segment sells back to the Carbon Black segment as well as supplying surplus electricity for external sale. All quarterly results are unaudited. Results are reported based for the period in question with no currency adjustments between reporting periods. Currency values reported in: Millions of INR | Segment | Parameter | Period | 2022 | 2021 | YoY, % | Notes |

|---|

| All Segments | Sales Revenue | 2022/1 | 14090.7 | 10038.5 | 40.4 | | | All Segments | EBIT | 2022/1 | 1693.1 | 1380.6 | 22.6 | | | All Segments | Net Margin | 2022/1 | 1259.1 | 1043.1 | 20.7 | | | Carbon Black | Sales Revenue | 2022/1 | 13739.0 | 9878.1 | 39.1 | | | Carbon Black | EBIT | 2022/1 | 1834.8 | 1800.9 | 1.9 | | | Carbon Black | Sales Vol MT | 2022/1 | 109377.0 | 109424.0 | .0 | |

Asahi (Bridgestone): Price Revision for Rubber Carbon Black Link...

Asahi Carbon is increasing the price for rubber grade carbon black by 46.3 yen/kg from August 1st 2022. Increases are required due to the tight feedstock supply situation and depreciation of the yen.

June (2022)

Cabot Corporation: Increasing EMEA Prices for Reinforcing Carbon Blacks Link...